The pandemic-induced boost to Facebook's growth, which was renamed Meta Platforms Inc. (FB) in October 2021 to reflect its increased concentration on the metaverse, is beginning to diminish. After three years of increasing expansion, sales and profitability growth slowed dramatically in the third quarter at the world's largest social network. Now, Chief Executive Officer (CEO) Mark Zuckerberg is significantly investing in virtual and augmented reality, betting that the metaverse will become the next phase of the internet, fueling the company's long-term development.

Important Takeaways

- Analysts predict $3.84 EPS in Q4 FY 2020, up from $3.88 in Q4 FY 2019.

- Monthly active users are predicted to increase year on year, although at a rate less than half that of the previous quarter.

- Revenue is predicted to rise, albeit at the slowest rate since the second quarter of the fiscal year 2021.

Investors will be waiting to see how Meta aims to reverse its decreasing growth, both in the short and long term, when it releases profits for the fourth quarter of the fiscal year 2021 on February 2, 2022. Analysts anticipate the firm will announce its first earnings per share (EPS) decrease since the second quarter of the fiscal year 2019, as sales growth slows to its weakest pace in six quarters.

Monthly active users (MAUs), a critical number that reflects the size of the company's user base, will also be scrutinized by investors. Despite the name change to Meta and the enormous resources dedicated to the development of the metaverse, the firm remains largely a social media business that sells advertising space across numerous social media platforms. Facebook, which Meta owns, is still the name of the company's primary social media platform and brand. Analysts predict that the company's MAUs will grow at the slowest rate in at least four years.

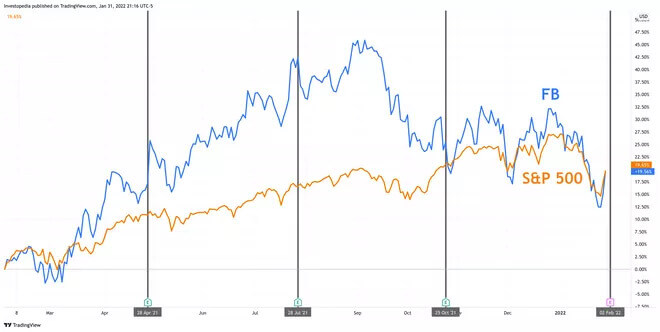

Over the last year, Meta shares have fared in line with the overall market. Between mid-March 2021 and late October 2021, the stock led the market, with a high-performance gap around early September. However, it soon began to fall precipitously, and its performance in October fell below that of the market. Since then, it has alternated between underperformance and outperformance. Over the last year, Meta's shares have produced a total return of 19.6%, almost in line with the S & P 500's total return of 19.7%.

Earnings History on Facebook (Meta)

Meta, which was still known as Facebook at the time, revealed mixed profit results for the third quarter of the fiscal year 2021. EPS surpassed analysts' forecasts, growing 18.5% over the previous quarter. It was the worst EPS growth rate since the fourth quarter of FY 2019. Revenue fell short of forecasts, increasing 35.1% year on year (YOY). It was the weakest rate of revenue increase since the fourth quarter of the fiscal year 2020. The business stated that it will begin reporting financial results for its new Facebook Reality Labs sector in the fourth quarter, as the company's focus on augmented and virtual reality grows.

Facebook announced earnings and revenue that above consensus projections in the second quarter of the fiscal year 2021. EPS increased 100.9% year on year, the greatest rate since the first quarter of fiscal 2020. Revenue increased by 55.6% over the previous year's quarter, the greatest rate of growth since at least the third quarter of FY 2018. In its quarterly release, the business stated that it anticipates third and fourth-quarter profits to decrease considerably sequentially.

Analysts predict a considerably lower result in the fourth quarter of the fiscal year 2021. They anticipate a 1.2% drop in earnings per share compared to the prior-year quarter, the first drop since the second quarter of the fiscal year 2019. Revenue is expected to climb 19.0% year on year, the slowest rate since the second quarter of fiscal 2020. Analysts predict that EPS will climb 38.0% in the fiscal year 2021, a considerable decrease from the 57.1% growth seen in the fiscal year 2020. Annual revenue is predicted to grow 36.8%, the greatest rate since FY 2018.

The Most Important Metric

As previously said, investors will be looking at Meta's MAUs, a crucial statistic that measures the size of the company's global active user base. An MAU is defined by Meta as a registered and logged-in user that accessed Facebook via its website or a mobile device or utilized its Messenger app at some point during the measuring period of 30 days. The majority of Meta's revenue comes from selling advertising space on its social networking platforms and applications to advertisers.

The more users it has, the more appealing its platform is to marketers. A larger user base makes it simpler to recruit new users since people want to be on Meta's platforms because their friends are, a typical illustration of the network effect. Meta's average revenue per user (ARPU) is another comparable indicator that indicates how successfully the firm is exploiting its user base.

Meta's MAUs have steadily increased over the last few years, although the rate has decreased. MAUs increased 13.4% year on year in the first quarter of FY 2018. By the fourth quarter of the year, that rate had dropped to 9.0% year on year. MAU growth had decreased to 7.6% by the fourth quarter of fiscal 2019. However, despite the epidemic, growth surged in FY 2020 as people spent more time online while staying at home. MAUs increased 9.6% year on year in Q1 FY 2020. By the end of the year, they were up 12.0% year over year. However, the slowdown trend has continued in FY 2021, with growth falling to 9.6% YOY in the first quarter and 7.2% YOY in the second quarter.

Comments (0)